NorthEast Radio Watch 12/8/2025: Cichon’s Back in Buffalo

In this week’s issue… Veteran newsman returns - Remembering NY's Leitner, RI's Jones - CT AM saved - Maine AM moves - "Indie" adds suburban signals

By SCOTT FYBUSH

We’re kicking off a big year in the history of NERW: the spring of 2014 will mark the twentieth anniversary of this column, and we’re planning a big celebration for all our loyal readers.

But before we get to the big two-oh, it’s time for our annual review of the year gone by. As we did last year, we’re bringing you Year in Review 2013 in a series of daily installments through New Year’s Eve, which we’ll collect on one page for archival purposes at the start of 2014.

We start this year’s rundown with a look at the signals that changed hands in 2013. For the first time, we actually have to note this year that this list does not include all of the FM translators that were sold during the year, if only because there were so many of them. In fact, if there can be said to be any kind of a sales boom in 2013 at the small end of the spectrum, it was in the world of translators. We saw sales as small as $500 for an unbuilt construction permit, and as large as $150,000 for a translator serving a sizable metro area – but for the most part, translator transfers hovered in the $30,000-$50,000 range. We’ve noted a few important exceptions along the way.

In the world of full-power signals, it was a slow year for radio transfers. There was just one sizable standalone FM sale in a major market, Merlin Media’s exit from Philadelphia. (We’re still waiting for the last big FM standalone shoe to drop, if Pacifica’s financial woes ever force a sale of WBAI in New York.)

Only a handful of significant radio groups changed hands, most notably Cox’s exit from southern Connecticut, Backyard’s selloff of its clusters in Elmira, Olean and Williamsport and the year-end transfer of the AAA stations on eastern Long Island to a new ownership group that included the stations’ PD. It was a good year for very small broadcasters trying to find a niche: the low prices for some minimal AM signals meant new entrants like Ed DeHart’s “AM Guys” in suburban Pittsburgh had the chance to get on the dial for not much more than they’d have spent for a new car.

On TV, it was a year of two trends: first, the continued consolidation of medium- and small-market signals in the hands of massive group owners such as Sinclair and, when necessary, their “sidecar” companies. (More about that when we run down the Top 10 Stories of the Year next week.) Second, this was the year when the spectrum speculators made the weight of their wallets felt, escalating the value of third-tier stations with the intent of entering their valuable UHF real estate in the FCC’s eventual spectrum auction, now set for 2015 at the earliest.

And in Canada, the trend of big conglomerates getting bigger continued, especially with the consummation of the Bell-Astral merger that spun several signals off to other big groups such as Newcap.

Let’s peruse the full list, month by month…

[private]

JANUARY:

Spectrum speculator OTA Television was the heavyweight buyer in the region as 2013 began, paying Sinclair $13.75 million for Providence-market WLWC (Channel 28) and Bill Binnie $4.1 million for little WYCN-LP (Channel 13) in Nashua. Unlike most of OTA’s stations, which end up running leased-time programming while awaiting the spectrum auction, WLWC is the market’s CW affiliate and is continuing to run as a “real” TV station for now – and even in Nashua, OTA ended up hiring WYCN’s former local managers and trying to fight Comcast’s plans to remove the low-power station from its lineup.

Spectrum speculator OTA Television was the heavyweight buyer in the region as 2013 began, paying Sinclair $13.75 million for Providence-market WLWC (Channel 28) and Bill Binnie $4.1 million for little WYCN-LP (Channel 13) in Nashua. Unlike most of OTA’s stations, which end up running leased-time programming while awaiting the spectrum auction, WLWC is the market’s CW affiliate and is continuing to run as a “real” TV station for now – and even in Nashua, OTA ended up hiring WYCN’s former local managers and trying to fight Comcast’s plans to remove the low-power station from its lineup.

At the small end of the spectrum, Great Radio LLC bought the license to WCBA (1350 Corning NY) for just $6,000, while the New England Public Radio Foundation bought a CP for 89.5 in Great Barrington from the Berkshire Community Radio Alliance for $7,500, leaving BCRA’s WBCR-LP as a low-power 97.7 signal and signing on 89.5 as WNNU, a relay of public station WNNZ from Springfield.

A notable translator sale: in Ithaca, Saga paid Calvary Chapel of the Finger Lakes $60,000 for W249CD (97.7), its fourth translator frequency in the market.

FEBRUARY:

Focusing on markets where it could combine TV, radio and in some cases print, Cox exited its long run in southern Connecticut, selling WPLR (99.1 New Haven), WEZN-FM (99.9 Bridgeport), WFOX (95.9 Norwalk) and the LMA of WYBC-FM (94.3 New Haven) to Connoisseur for $40 million.

Even bigger numbers (for larger groups of stations) came from the TV side, where Sinclair paid $320 million for Barrington’s TV stations, including WSTM (Channel 3)/WSTQ-LP (Channel 14) in Syracuse. Sinclair also expanded in western Pennsylvania with a $99 million purchase of several outlying Cox stations, including WJAC (Channel 6) in Johnstown and WTOV (Channel 9) in Steubenville, Ohio.

At the lower end of the TV price scale, New Age Media sold Portland’s WPXT (Channel 51) to Ironwood Communications for $1,525,000 – still a low price for a station that was once Portland’s Fox affiliate, but at least a reasonable figure – while sister station WPME (Channel 35) went from MPS Media to Cottonwood Communications for just $75.000. That low price reflects what Cottonwood was really buying, which amounts to the WPME license and programming. Just as MPS did, Cottonwood entered into a deal with WPXT under which Ironwood will operate the My affiliate, selling air time and providing operational services for WPME for a fee of $30,000 a month. The deal also included a spinoff of WPXT’s real estate in Westbrook, for which Ironwood will assign purchase rights to Admiralty Properties, LLC for $1.3 million.

In Albany, Hubbard joined the duopoly club, adding MyNetwork TV affiliate WNYA (Channel 51) to its NBC affiliate, WNYT (Channel 13), in a $2.3 million buy from Venture Technology.

MARCH:

A quiet month, except in suburban Rochester,where Brian McGlynn’s Genesee Media picked up WASB (1590 Brockport)/WRSB (1310 Canandaigua) from Marilyn Wolfe for $450,000.

APRIL:

Another quiet month in sales-ville, with the only license transfer of note happening in litte Taylortown, New Jersey, where Redeemer Broadcasting bought a construction permit for 90.3 from Calvary Chapel of Montclair for $45,000. (The signal signed on in September as WNEQ.)

MAY:

The month’s big cluster deal was Backyard Broadcasting’s exit from the Olean and Elmira/Corning markets, selling its clusters there (one AM/FM in Olean and two AMs/three FMs in Elmira/Corning) to Community Broadcasters for $3.6 million as Jim Leven and Bruce Mittman moved southward from their base in Watertown.

The month’s big cluster deal was Backyard Broadcasting’s exit from the Olean and Elmira/Corning markets, selling its clusters there (one AM/FM in Olean and two AMs/three FMs in Elmira/Corning) to Community Broadcasters for $3.6 million as Jim Leven and Bruce Mittman moved southward from their base in Watertown.

New York’s WNYC extended the reach of its classical WQXR with the $400,000 purchase of WDFH (90.3 Ossining) from Marc Sophos’ community group there. Other six-figure radio deals included the sale of a partial interest in KQV (1410 Pittsburgh) to the new “22 Minutes LLC” from Richard Scaife for $200,000 and Tim Martz’ $225,000 purchase of WSNN/WPDM in Potsdam from St. Lawrence Radio.

In Williamsport, Pennsylvania, the Lycoming Broadcast Foundation paid Pennsylvania Technical College $125,000 for WPTC (88.1), turning it from a university into a community licensee. That noncommercial FM’s price far eclipsed two small AM deals: GEOS paid Panorama $30,000 for WAZL (1490 Hazleton), and Ed DeHart’s “AM Guys LLC” paid Business Talk Radio Network just $14,515 for WLFP (1550 Braddock) in the Pittsburgh market.

Also in Pittsburgh, OTA Broadcasting paid a whopping $7.25 million for the chain of low-power TV signals that made up the Bruno-Goodworth Network (WBGN), looking forward to a payoff in the spectrum auctions.

And in the “small ownership” department, Beaver Springs Faith Baptist Church paid Apostolic Faith Network $10,500 for unbuilt WXPA (90.5 Kulpmont PA), while Cove Mountain Educational Trust paid Morris Broadcasting $20,000 for WWCF (88.7 McConnellsburg PA).

JUNE:

The only seven-figure deal of the month wasn’t really a sale, as such: as Ed Levine’s Galaxy group refinanced, ownership cap issues forced it to transfer WZUN (102.1 Phoenix) to the new “WZUN Communications” for $1 million, in order to stay under the cap in the Syracuse market. WZUN is still running out of the Galaxy cluster, and a clever move by Levine later in the year (shifting one of his Oswego stations to a new community outside the Syracuse market boundaries) will allow him to bring WZUN back into Galaxy’s ownership sooner or later.

Down the road in the Rochester market, Family Stations’ slow exit included a $655,000, three-station sale to EMF Broadcasting, which got stations in California, Texas and WFRW (88.1 Webster).

In Olean, Bill Christian’s Malachi Media paid Choice Tower Rental $125,000 for WVTT-CA (Channel 25).

And two stations on 1360 found new religious owners: WTOC (1360 Sussex NJ) went from Radio Vision Cristiana to Centro Biblico of New Jersey for $235,000, while Renda donated WMNY (1360 McKeesport PA) to Loren Mann’s Pentecostal Temple Development Corp.

JULY:

The month’s blockbuster deal was the first step in the breakup of Tribune’s newspaper and broadcast holdings: because Tribune’s Allentown Morning Call overlaps coverage with its WNEP (Channel 16) in Scranton, WNEP became one of two Tribune TV outlets transferred to Dreamcatcher Broadcasting in a $27 million deal. (The other was WTKR/WGNT in Norfolk, Virginia.) Dreamcatcher, of course, then leased the stations back to Tribune to operate, drawing complaints from watchdog groups challenging media consolidation around the country.

Up in Canada, Rogers actually de-consolidated slightly, spinning off standalone news outlets CKNI (91.9 Moncton) and CHNI (88.9 Saint John) to Acadia and Newcap, respectively. Acadia is paying C$1,625,000 in Moncton, and Newcap is paying C$750,000 in Saint John, with formats to flip when the deals finally close.

Up in Canada, Rogers actually de-consolidated slightly, spinning off standalone news outlets CKNI (91.9 Moncton) and CHNI (88.9 Saint John) to Acadia and Newcap, respectively. Acadia is paying C$1,625,000 in Moncton, and Newcap is paying C$750,000 in Saint John, with formats to flip when the deals finally close.

In Maine, Blueberry Broadcasting began exiting the AM dial with the $16,200 sale of WFAU (1280 Gardiner) to maverick broadcaster Bob Bittner’s Blue Jey Broadcasting.

AUGUST:

The biggest TV deal of the year to hit NERW-land was the $988 million Sinclair purchase of Allbritton Communications. In addition to Allbritton’s bigger outlets in markets such as Washington and Birmingham, Sinclair also gets Harrisburg ABC affiliate WHTM (Channel 27) – and draws the attention of the FCC for its plans to shuffle its existing Harrisburg operation, CBS affiliate WHP-TV (Channel 21) and the LMA of WLYH (Channel 15), into its “sidecar” operator, Deerfield Media. At year’s end, the sale remained tied up at the FCC awaiting approval.

In Syracuse, Sinclair’s acquisition of WSTM forced the $20 million sale of its existing station, WSYT (Channel 68), to another “sidecar,” Bristlecone Broadcasting, which also picks up the LMA of My outlet WNYS (Channel 43).

Yet another Sinclair sidecar, Cunningham Broadcasting, was also active, paying Horseshoe Curve Broadcasting $8 million for WWCP (Channel 8), the Fox station in Johnstown-Altoona. (Cunningham also picked up the operation of ABC affiliate WATM, channel 23, combining them with Sinclair’s WJAC, the NBC affiliate.)

In the world of radio, Cumulus raised some quick cash for its big acquisition of Dial Global/Westwood One by selling 53 stations to Townsquare Broadcasting. In NERW-land, that $238 million deal included the Cumulus stations in Portland, Maine, Portsmouth, N.H., Danbury, Connecticut and the Hudson Valley.

In the world of radio, Cumulus raised some quick cash for its big acquisition of Dial Global/Westwood One by selling 53 stations to Townsquare Broadcasting. In NERW-land, that $238 million deal included the Cumulus stations in Portland, Maine, Portsmouth, N.H., Danbury, Connecticut and the Hudson Valley.

The biggest radio deal exclusive to NERW-land was Merlin Media’s exit from Philadelphia, where EMF Broadcasting shelled out $20.25 million for WWIQ (106.9 Camden NJ), $2 million less than Merlin had paid for the former WKDN-FM in 2011.

Backyard’s last remaining cluster, its one AM and five FMs in Williamsport, Pennsylvania, went to local manager Dan Farr, whose new group also goes by “Backyard,” paying $5.5 million to take the stations local.

In the Berkshires, Vox Communications filed to sell its four AMs and two FMs to Reed Miami Holdings LLC. The deal included an unusual sale contract in which the closing price would include a $300,000 deposit and 5.25 times each station’s broadcast cash flow. How much does that add up to? We don’t know – and neither did local competitor WBRK in Pittsfield, which held up the sale with a complaint to the FCC that’s still pending at year’s end.

SEPTEMBER:

Sinclair was at the forefront of TV deal-making once again, paying $90 million for New Age’s TV stations. That includes Wilkes-Barre/Scranton Fox affiliate WOLF-TV (Channel 56) and its sisters, WSWB (Channel 38) and WQMY (Channel 53).

Up the road in Binghamton, Nexstar already owns ABC affiliate WIVT (Channel 34) and its low-power NBC sister, WBGH (Channel 20), and its “sidecar” company. Mission, is paying $15.25 million for Fox affiliate WICZ (Channel 40) if the FCC gives its approval.

In Vermont, Christian Ministries paid Northeast Gospel Network $125,000 for WNGF (89.9 Swanton); in northern New Jersey, a $30,000 deal sent the license of WXMC (1310 Parsippany-Troy Hills) from James J. Chladek to Edison-based World India Radio, led by Hasmukh Shah. World India Radio is also buying WXMC’s real estate in a separate deal.

OCTOBER:

With the government – and thus the FCC – shuttered for several weeks, the volume of transactions dropped. During the shutdown, longtime Elmira owner Robert Pfuntner struck a deal to unload most of his Pembrook Pines Mass Media N.A. Corp. after years of financial troubles. The deal to sell Pembrook Pines’ Elmira and Bath signals to Randy Reid’s Titan Radio, LLC. is valued at $2.75 million, with $700,000 payable at closing and $1.9 million over the next eight years, including a time brokerage agreement ahead of the sale.

In Northern Cambria, north of Johnstown, Pennsylvania, WPCL (97.3) changed hands from one regional religious network to another. He’s Alive, which has owned the station since 1997, will get $200,000 in cash when it transfers the class A signal to the Central Pennsylvania Christian Institute, which will use it as a western simulcast of WTLR (89.9 State College). That full-power signal fetched not much more than an especially lucrative translator: in Allentown, Family Life Networks sold translator W234AX (94.7) to Connoisseur Media for $140,000.

The last remaining piece of Business Talk Radio Network, WGCH (1490 Greenwich), headed to Rocco Forte’s Forte Family Broadcasting for $250,000.

On the Canadian side, James Houssen applied to buy CJRP-FM (103.5 Saint John NB) and its Rothesay relay, CJRP-FM-1 (95.1), from Pritchard Broadcasting for C$5000.

On TV, Utica’s WKTV (Channel 2) was the last remaining piece of Smith Broadcasting, and for $16 million, plus an assumption of debts, it’s on its way to a new Atlanta-based company called Heartland Media.

NOVEMBER:

Sinclair’s growth spurt included a $13.6 million acquisition of the non-broadcast assets of Portland-market Fox affiliate WPFO (Channel 23) from Max Media, pairing the station with CBS affiliate WGME (Channel 13).

On the Jersey Shore, spectrum speculator LocusPoint Networks struck a $6 million deal to buy NBC affiliate WMGM-TV (Channel 40) from Access.1, which will lease the station back until the spectrum auction.

Some of the month’s top radio deals were noncommercial. Off the coast, Dennis Jackson’s WMEX (88.7 Edgartown) went to the Friends of WMVY in a $450,000 deal that will see 88.7 become the new over-the-air home of Martha’s Vineyard’s WMVY in 2014, more than a year after it went streaming-only.

Some of the month’s top radio deals were noncommercial. Off the coast, Dennis Jackson’s WMEX (88.7 Edgartown) went to the Friends of WMVY in a $450,000 deal that will see 88.7 become the new over-the-air home of Martha’s Vineyard’s WMVY in 2014, more than a year after it went streaming-only.

In Albany, Radio Disney’s AM selloff included a $375,000 sale of silent WDDY (1460) to Catholic broadcaster Pax et Bonum, Inc., which will return it to the air as a simulcast of WOPG (89.9 Esperance).

A long-running LMA turned into a station sale in the mountains of south central Pennsylvania, where Cary Simpson’s Allegheny Mountain Network continued its slow exit from the business with the $400,695 sale of WEEO-FM (103.7 McConnellsburg) to Magnum Broadcasting. Magnum has been operating WEEO-FM since 2008, running it as “FM Talk 103.7.

And in Ithaca, Saga stepped forward as a $715,000 bidder for the one big commercial station it didn’t already own, ROI Broadcasting’s WFIZ (95.5 Odessa). A bankruptcy court must still approve that sale before it can be finalized.

DECEMBER:

The month’s big deal was a radio one at the east end of Long Island, where Lauren Stone is moving up from PD at the AAA Licensing cluster on the East End to the owner’s chair. Along with her father, Roger Stone, she’s paying $3.2 million for the four stations AAA had been operating with funding provided by Arlington Capital. The new LRS Radio cluster includes AAA WEHM (92.9 Manorville)/WEHN (96.9 East Hampton), the stations Lauren Stone’s been programming, along with top-40 WBEA (101.7 Southold) and soft AC WBAZ (102.5 Bridgehampton).

Heading south, Ken Pustizzi completed his $400,000 purchase of WSNJ (1240 Bridgeton) and its sister cable outlet, “QBC” channel 2, from Jim Quinn. Operating as “Quinn Communications and Marketing LLC,” Pustizzi has been operating WSNJ under an LMA from Quinn since October.

And in southern Rhode Island, John Fuller’s Red Wolf Broadcasting bought back a station Fuller had put on the air two decades ago. Red Wolf paid Judson Group just $12,500 for the license to classical WCRI (1180 Hope Valley), flipping the daytimer to oldies as WSKP.

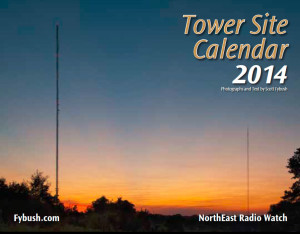

It’s become a legendary part of the broadcast landscape, found on the finest transmitter-site walls and in engineering offices from coast to coast and around the world.

It’s become a legendary part of the broadcast landscape, found on the finest transmitter-site walls and in engineering offices from coast to coast and around the world.

The 2014 Tower Site Calendar is ready to send for YOU (or someone else), spiral bound, shrink wrapped and best of all, with a convenient hole for hanging!

This year’s pinups include the iconic towers of Catalina Island, a combiner system in St. Louis, the twin towers of KNRS in Salt Lake City, a historic rooftop site in Jamestown, New York and many more!

Click here to order your 2014 calendar! We’re now shipping daily, so you can have your calendar on your wall before it’s time to flip the page from 2013 into 2014…

In this week’s issue… Veteran newsman returns - Remembering NY's Leitner, RI's Jones - CT AM saved - Maine AM moves - "Indie" adds suburban signals

In this week’s issue… Scripps stations face takeover - Sinclair moves more affiliations - CT stations sold - Maine AM surrendered - Remembering WVBR's Shapiro, WABC's Morgan

In this week’s issue… CT TV legend succumbs to cancer - Remembering PA's Adams - FCC still stalled by shutdown - Pittsburgh morning host exits

In this week’s issue… FCC faces reopening challenges - Veteran Boston anchor retires - Morning shift in Toronto - NYC FMs expand reach